For companies seeking sustainable growth, Japan represents one of the most attractive, stable, and integrity-driven markets in the world. Despite its reputation for being selective and culturally complex, Japan consistently rewards those who approach it strategically—with high customer loyalty, predictable profitability, and long-term brand value.

Below are key reasons why entering Japan should be part of every company’s international growth strategy.

1. A High-Value Market That Rewards Quality

Japan is the third-largest economy globally, with consumer spending power that rivals the United States and Europe. But what makes Japan truly distinctive is not its size—it’s the depth and durability of its demand.

Japanese consumers value performance, craftsmanship, and service. Products that meet these expectations often enjoy premium pricing and remarkable brand longevity..

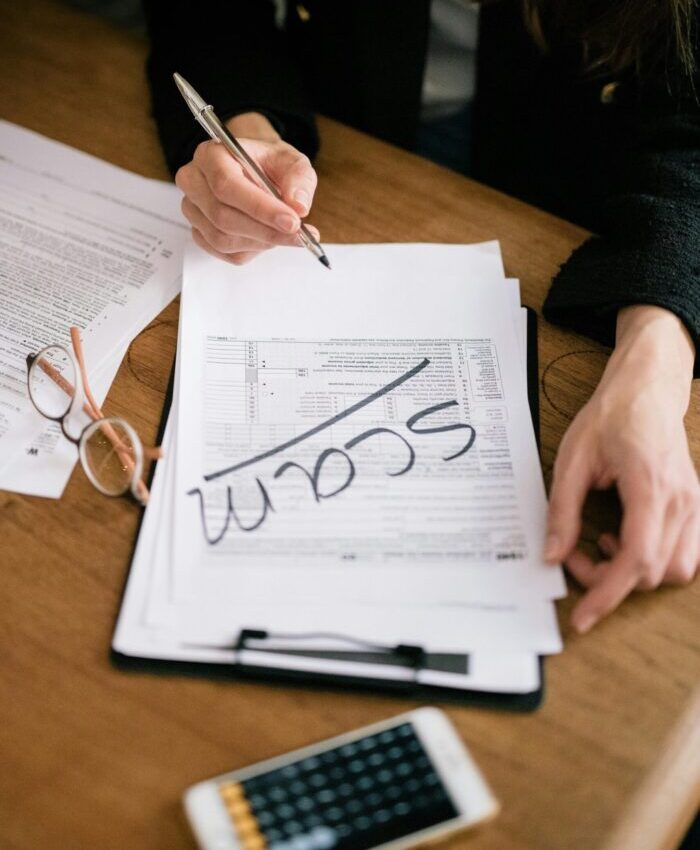

2. Business Culture Built on Trust and Integrity

Japan’s commercial environment is one of the most transparent and ethical in the world. Contracts are respected, invoices are paid on time, and business relationships are built on mutual trust rather than short-term opportunism.

For global executives used to managing risk in volatile or opaque markets, Japan offers a predictable, rules-based ecosystem where ethical business still holds real competitive advantage.

3. Long-Term Partnerships Over Quick Transactions

Japanese distributors and corporate clients rarely switch suppliers without cause. Once trust is established, relationships tend to be long-lasting and mutually beneficial.

This stability reduces churn, lowers business development costs over time, and allows companies to build steady recurring revenue from a mature and loyal customer base.

4. Strategic Gateway to Asia

A successful presence in Japan often becomes a springboard into broader Asia-Pacific expansion. Japanese partners, investors, and distributors carry global credibility, and a product that succeeds in Japan gains reputational leverage across Asia.

Many companies have found that “validated in Japan” opens doors not only in Korea, Taiwan, and Singapore, but even in Western markets where Japanese endorsement signals reliability and quality.

5. Exceptional Infrastructure and Supply Chain Reliability

Japan’s infrastructure—from logistics to data networks—is world-class. Distribution networks operate with near-perfect reliability, and the country’s advanced e-commerce, healthcare, and manufacturing ecosystems make it an ideal environment for precision-driven products and services.

For companies concerned with supply chain disruption or counterfeit risk, Japan offers a secure, transparent, and well-regulated platform for commercial operations.

6. A Market That Strengthens Your Global Brand

Doing well in Japan is more than a commercial success—it’s a statement of capability. Japanese consumers and corporate buyers are among the world’s most discerning. If your product meets their expectations, it can meet anyone’s.

Global companies often find that success in Japan enhances brand reputation, investor confidence, and competitive positioning worldwide.

7. Strong Legal and IP Protection Framework

Japan’s intellectual property laws and enforcement mechanisms rank among the most robust globally. For companies in pharmaceuticals, medtech, software, and design, this makes Japan a safe market for technology transfer, innovation partnerships, and high-value intellectual assets.

Final Word: Japan Rewards Serious, Strategic Entrants

Japan is not a market for opportunistic or short-term players. It demands commitment, quality, and cultural understanding. But for companies that invest properly, Japan delivers steady profits, low business risk, and unmatched reputational value.

At Invision Japan, we specialize in helping companies enter, manage, and grow their business in Japan—bridging the cultural gap and aligning local partners for long-term success.